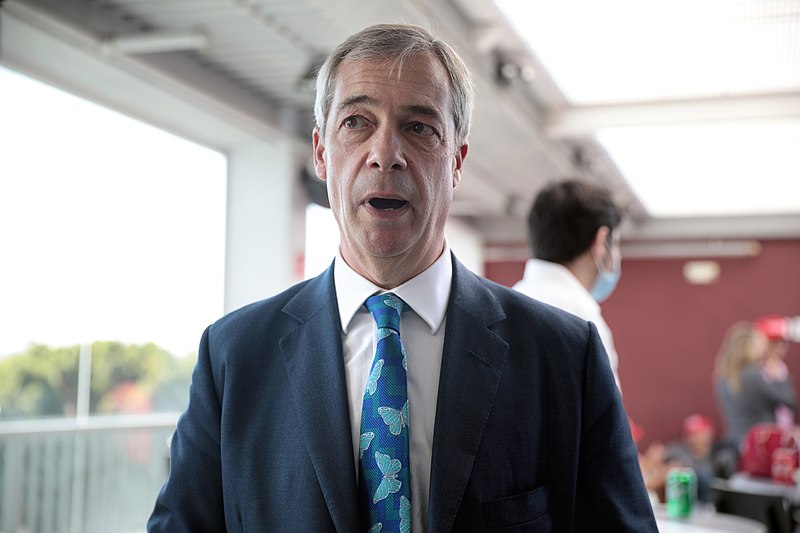

The ‘Debanking’ of Nigel Farage

Print Deputy Editor Charlie Gershinson examines the recent saga of Nigel Farage and the closure of his bank account.

Nigel Farage has for decades been a name synonymous with populism and disestablishmentarianism, due to his development of the United Kingdom Independence Party (UKIP) from a fringe faction dismissed by the general body politic to perhaps the most significant political movement in a generation of more, fulfilling its central objective of leaving the European Union.

Three years after the Brexit referendum, Farage roared back onto the political scene to found the Brexit Party which, within months, came first in the 2019 European Elections, relegating the Conservatives into a pitiful fifth place and hammering the final nail into the coffin for Theresa May.

Once more, the lion is rearing its head to draw attention to another issue of interest and controversy: the loss of his Coutts bank account and potential swathes of so-called ‘debanking’ amongst members of the political class.

The story began when Farage revealed in a video on June 29th that a bank had decided to close his account seemingly without justification, with Farage claiming this was due to his political beliefs. The following days and weeks saw a series of sourced claims which both supported and repudiated Farage’s theory.

The BBC’s business editor Simon Jack revealed that Farage’s account with the exclusive bank Coutts – which is known to be used by members of the royal family –had been closed because his balance had fallen below the threshold needed to keep the account open. The minimum amount needed to open an account with Coutts is £1 million in investments, including a mortgage, or £3 million in savings. However, this explanation began to fall apart when it was revealed that Jack’s source was none other than Dame Alison Rose, the CEO of NatWest, who had sat next to Jack at a charity dinner the night before his report.

The day before, Farage had obtained a 40-page dossier seemingly supporting his original claim that he was ‘debanked’ because of his political ideology. It was made clear the bank believed him to be a ‘reputational risk’ due to his habit of “court[ing] controversy” and referred to multiple instances that the bank deemed to support this high level of reputational risk. These included: Jewish groups criticising Farage for calling cabinet minister Grant Shapps – who is Jewish – “globalist”; a tweet by Farage which saw him link the promotion of diversity and multiculturalism to ethnic and religious violence in Leicester and Farage’s resignation from LBC (with whom he produced a regular radio show) after comparing the Black Lives Matter movement to the Taliban.

However, Rose’s claim that Farage’s account was below the minimum threshold was not without basis. The end of the document does reveal that part of the justification for the account closure was due to the relationship “being below commercial criteria for some time” and that “The exit [of Farage from Coutts] was expected to be in Q3 2023 however the mortgage has been repaid early and the security released which is triggering an earlier notification of exit to the client”.

The aftermath of the scandal has seen the resignation of Rose, who was also terminated as a business adviser to the government, and Peter Flavel who was formerly in charge of Coutts. Farage continues to call for the resignation of the entire board of Coutts and has said that the bank has since offered to keep his account open.

A large part of Coutts’ justification for terminating Farage’s account was his status as a ‘politically exposed person’ (PEP). A PEP is a high-profile public figure, such as an MP, who is deemed more susceptible to bribery and money laundering and so is subject to extended checking by financial institutions, as well as their close family and friends. Coutts felt that under PEP rules, they were able to terminate Farage’s account as his political connections presented a threat to their reputation.

Coutts felt that under PEP rules, they were able to terminate Farage’s account as his political connections presented a threat to their reputation.

More specifically, the Coutts report noted Farage’s links to Russian-aligned media. While Coutts did not see Farage as having a “direct “Russian regime” connection”, they used his payments from appearances on Russia Today, a television network ultimately owned by the Russian government, over the years (including after the Russian invasion of Ukraine) as evidence of a reputational risk.

The method by which Coutts terminated Farage as a client has brought the current system of PEPs under debate as it seems to be able to bypass the right of every person to open a bank account. Parliamentarians see this as a double standard where politicians are punished merely because of their political views or their public status while money launderers go unhindered.

The recently approved Financial Services and Markets Bill will require regulators to review how banks are treating PEPs.

The debacle has opened a further debate on how banks influence public figures, particularly those on the right. Conservatives have claimed that bank executives and employees are biased against them with other claims since emerging that Chancellor of the Exchequer Jeremy Hunt was refused an account with the bank Monzo due to his status as a PEP. Anecdotes of anti-Conservative bias have also emerged amongst some staff at Monzo as Slack chats revealed the Conservatives described as “evil” and “ugly” and celebrations at the Conservatives’ losses at the local elections. A spokesperson for Monzo has since said: “These cherry-picked comments are personal views of a handful of employees in informal conversations and it is wrong to portray them as the views of Monzo or our thousands of other employees.”